Reconcile Income Transactions

Reconcile Income Transactions

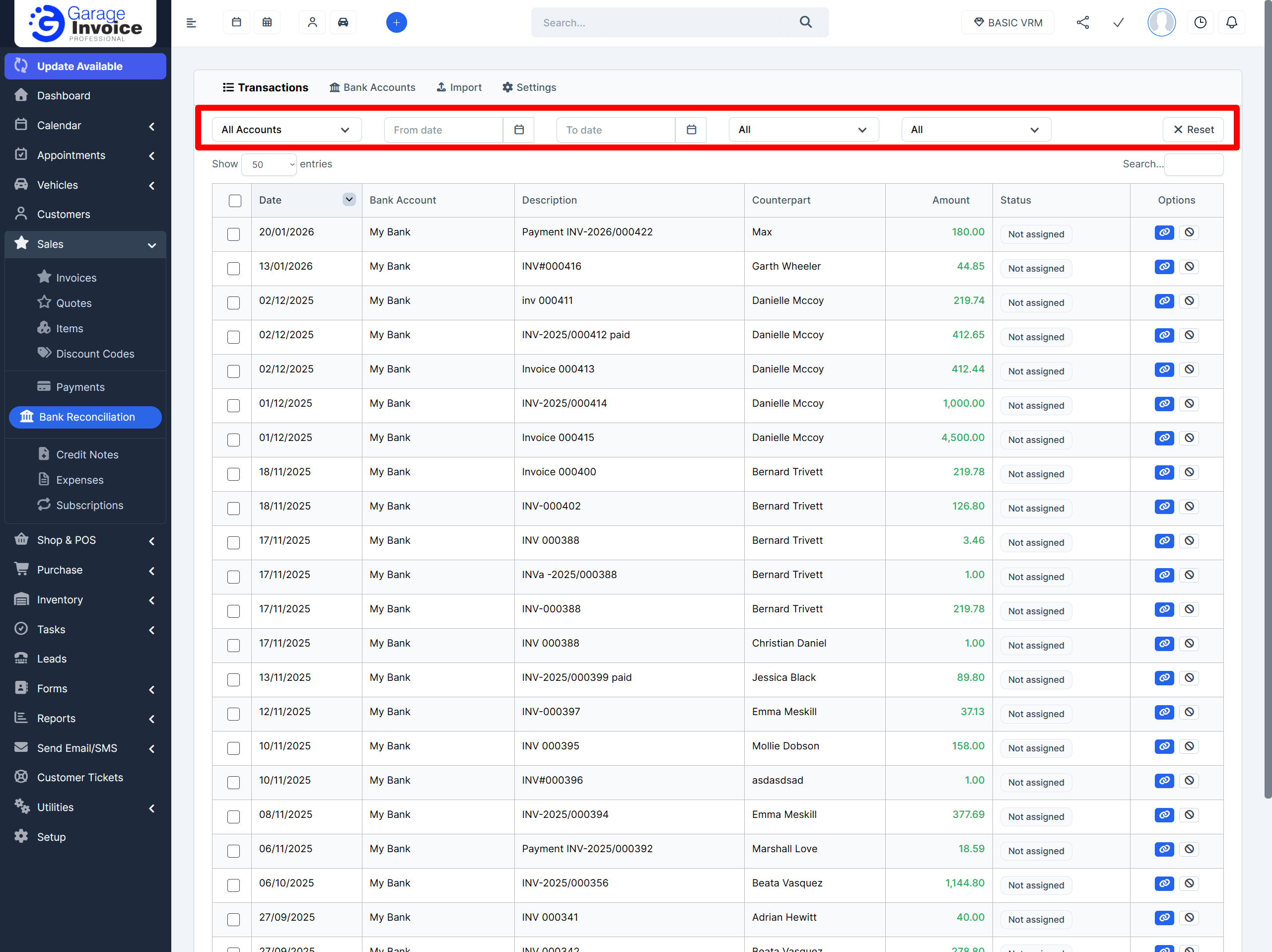

Where to find your transactions

Navigate to Sales → Bank Reconciliation → Transactions.

Here you’ll see all transactions that were imported from your bank statement CSV file.

Each row includes the date, the bank account it was imported into, description, counterpart, amount, and status.

Income vs expense (how to tell them apart)

Income transactions are shown in green and displayed as a positive amount.

Expense transactions are shown in red and displayed as a negative amount (with a minus sign).

Use filters to find what you need

Above the transactions table you’ll find filters to help you narrow things down, for example:

by date range / period

by status

by type (Income or Expense)

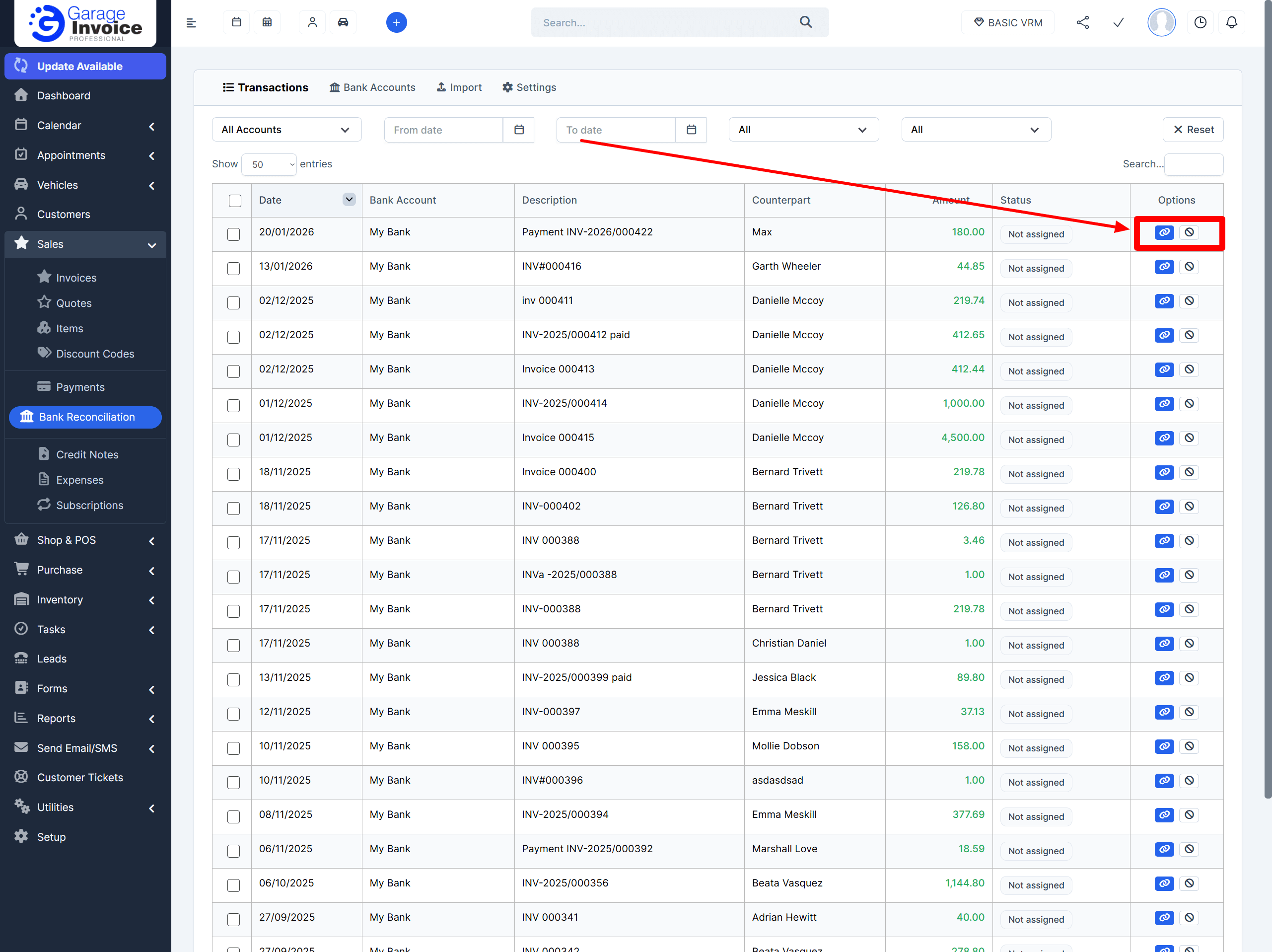

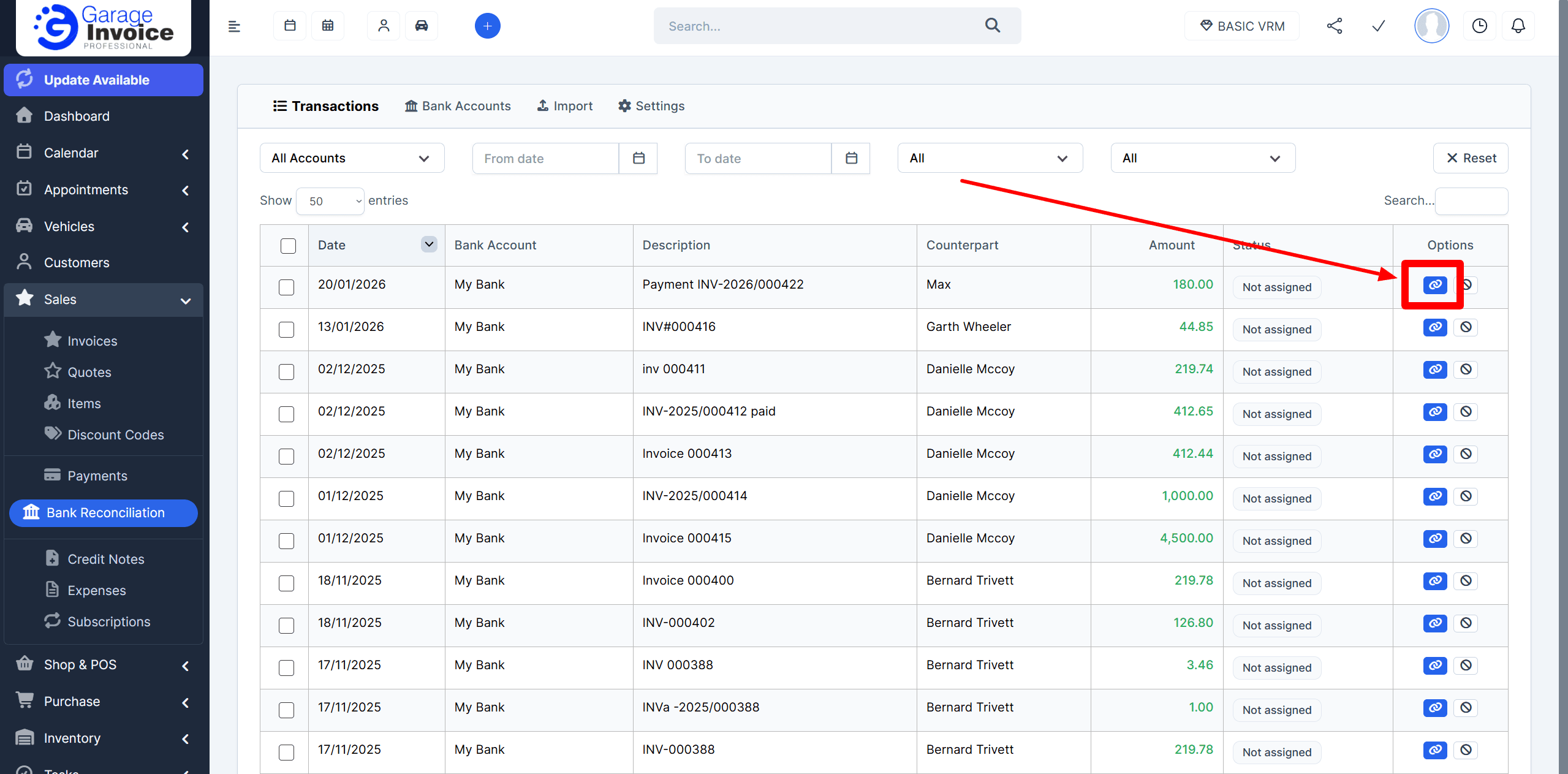

Available actions

For each transaction you have two options:

Reconcile

How to reconcile an income transaction

Click the blue chain icon

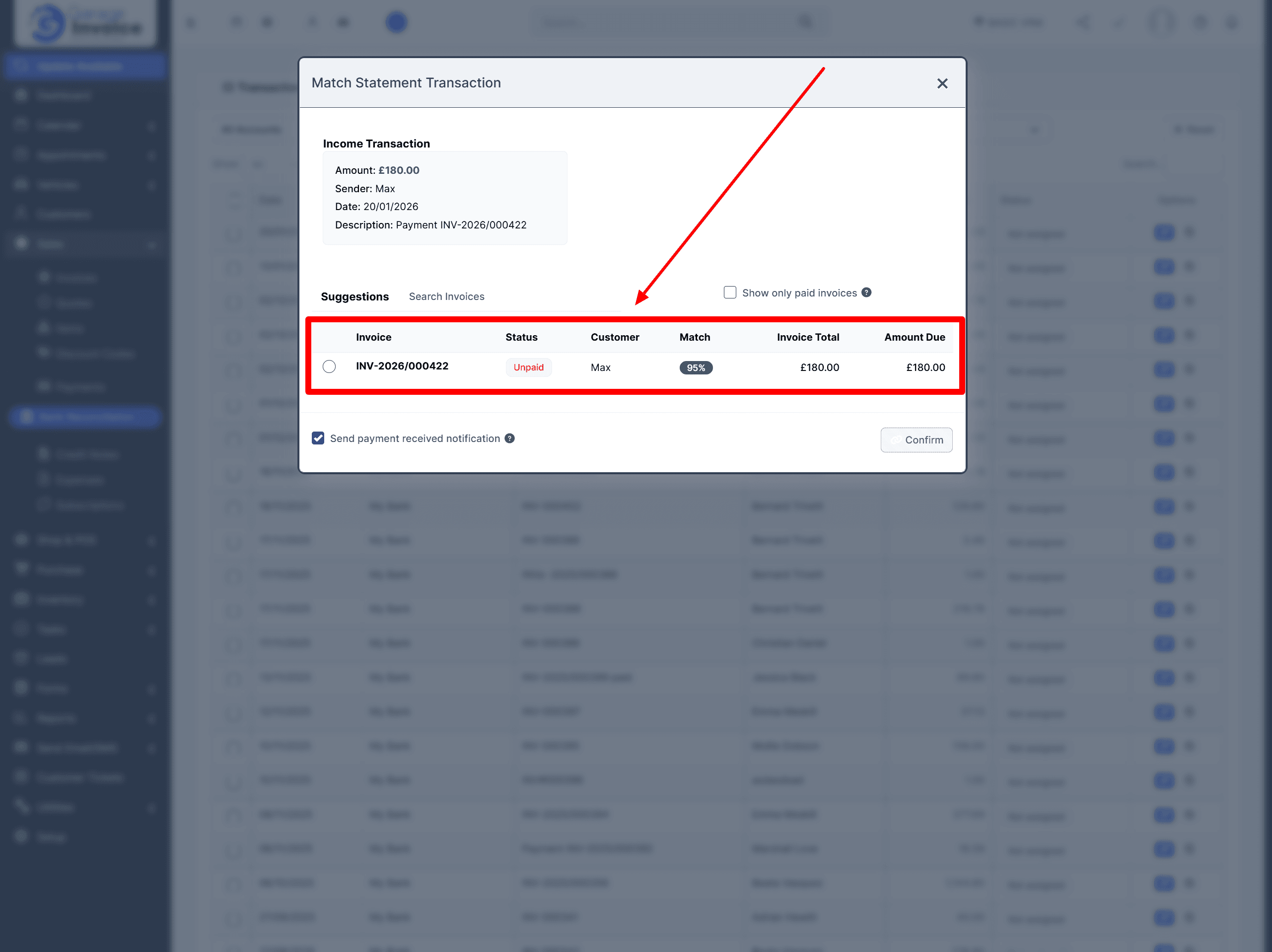

This opens the matching screen where you can link the bank transaction to an invoice in the system.

Review suggested matches

The system will show invoice suggestions based on the transaction amount, date, description, and sender/counterpart.

Each suggestion includes a match percentage (%) to help you choose the most likely invoice.

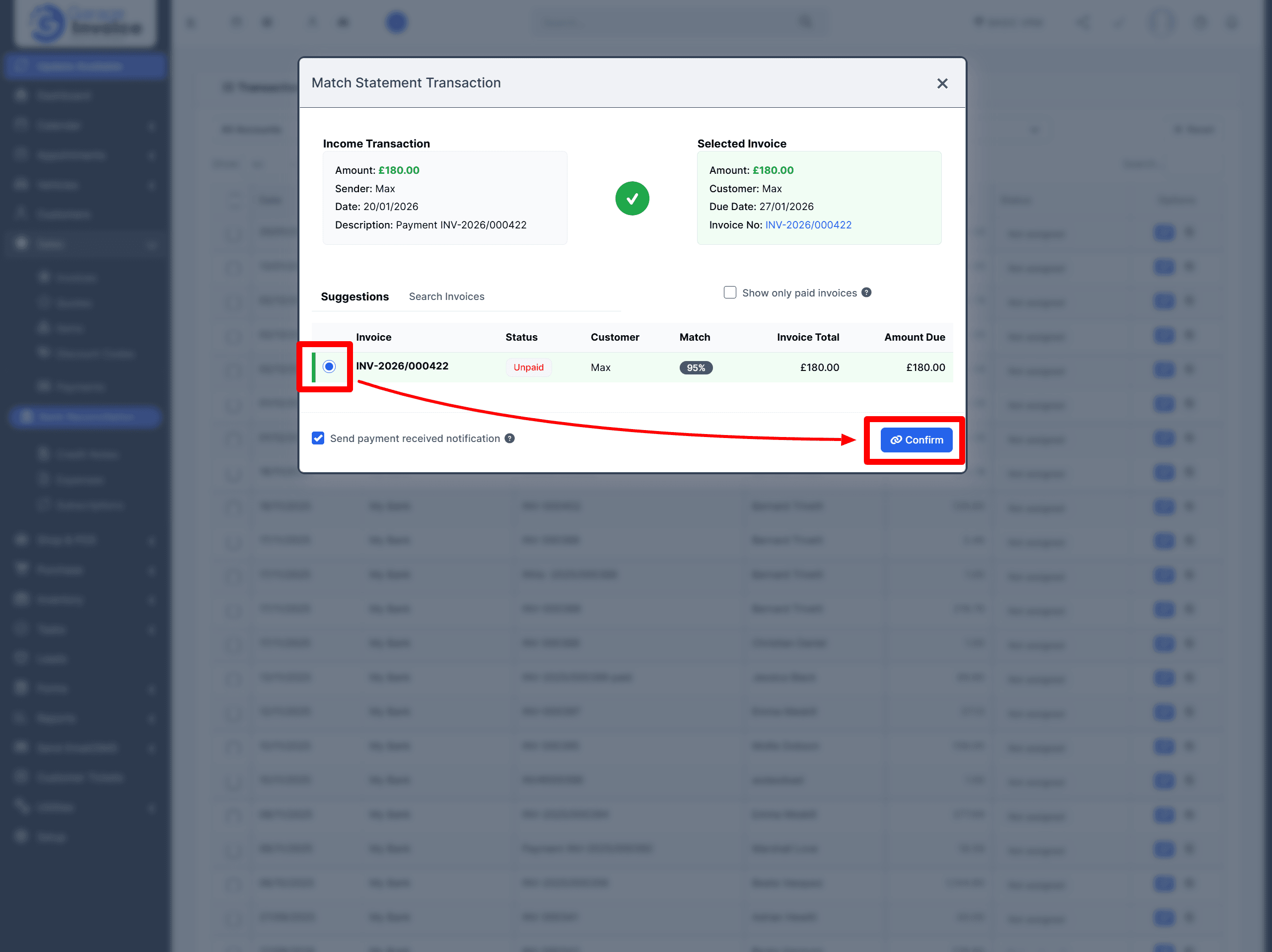

Select the correct invoice and confirm

Click the invoice you want to match, then click Confirm.

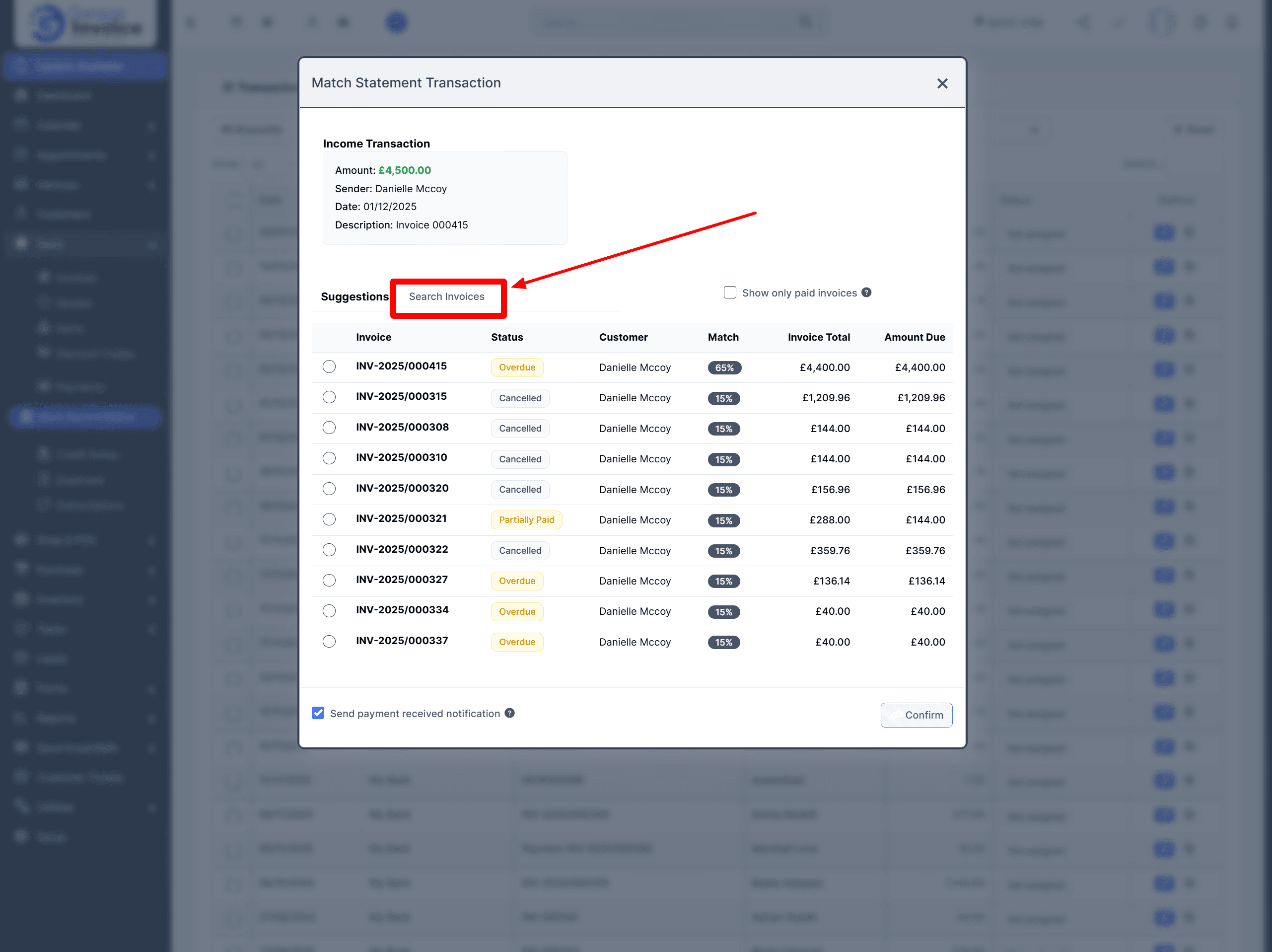

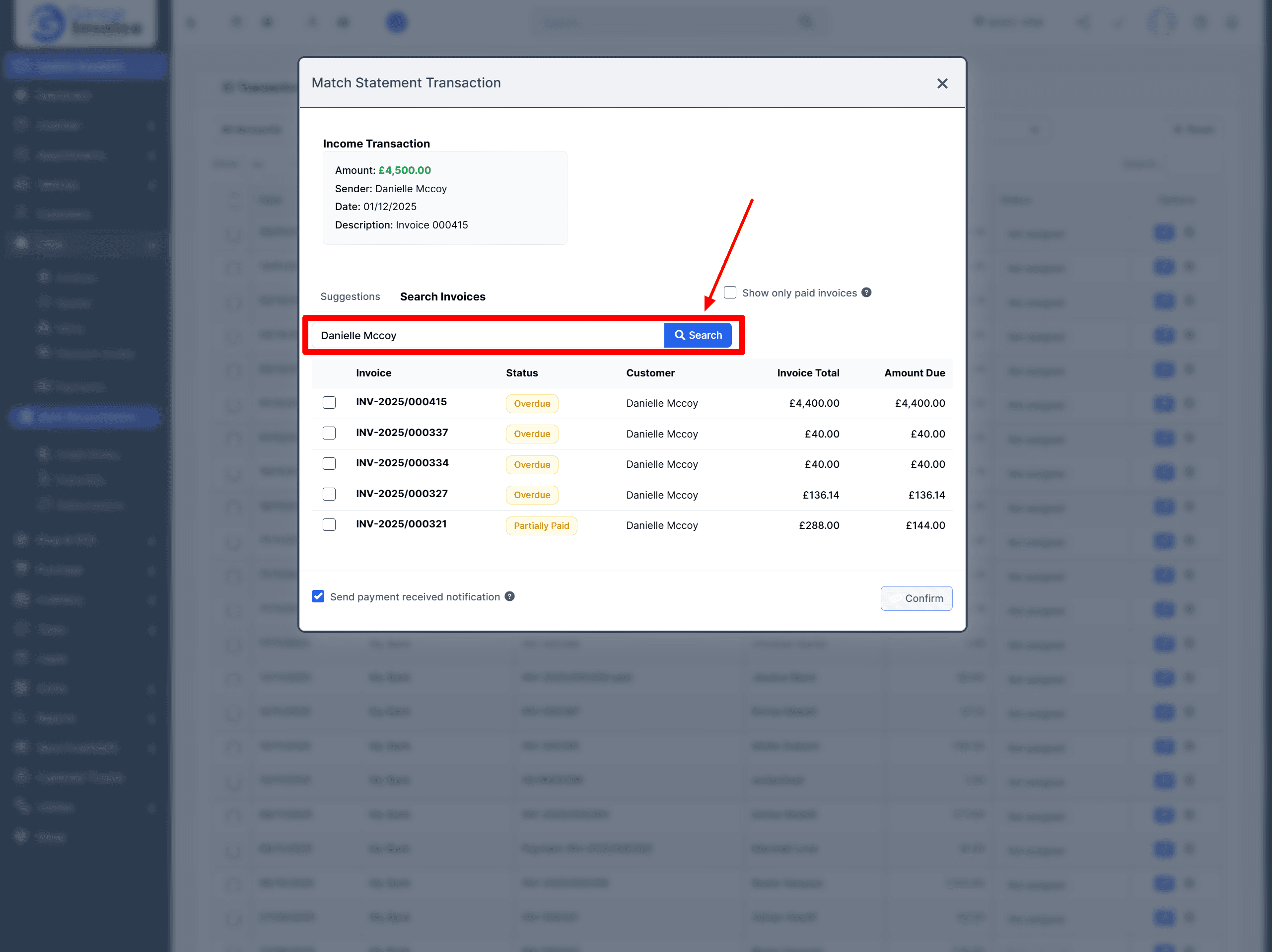

If the invoice is not in the suggestions

If you can’t see the right invoice in the suggested list:

This will display a full list of matching invoices.

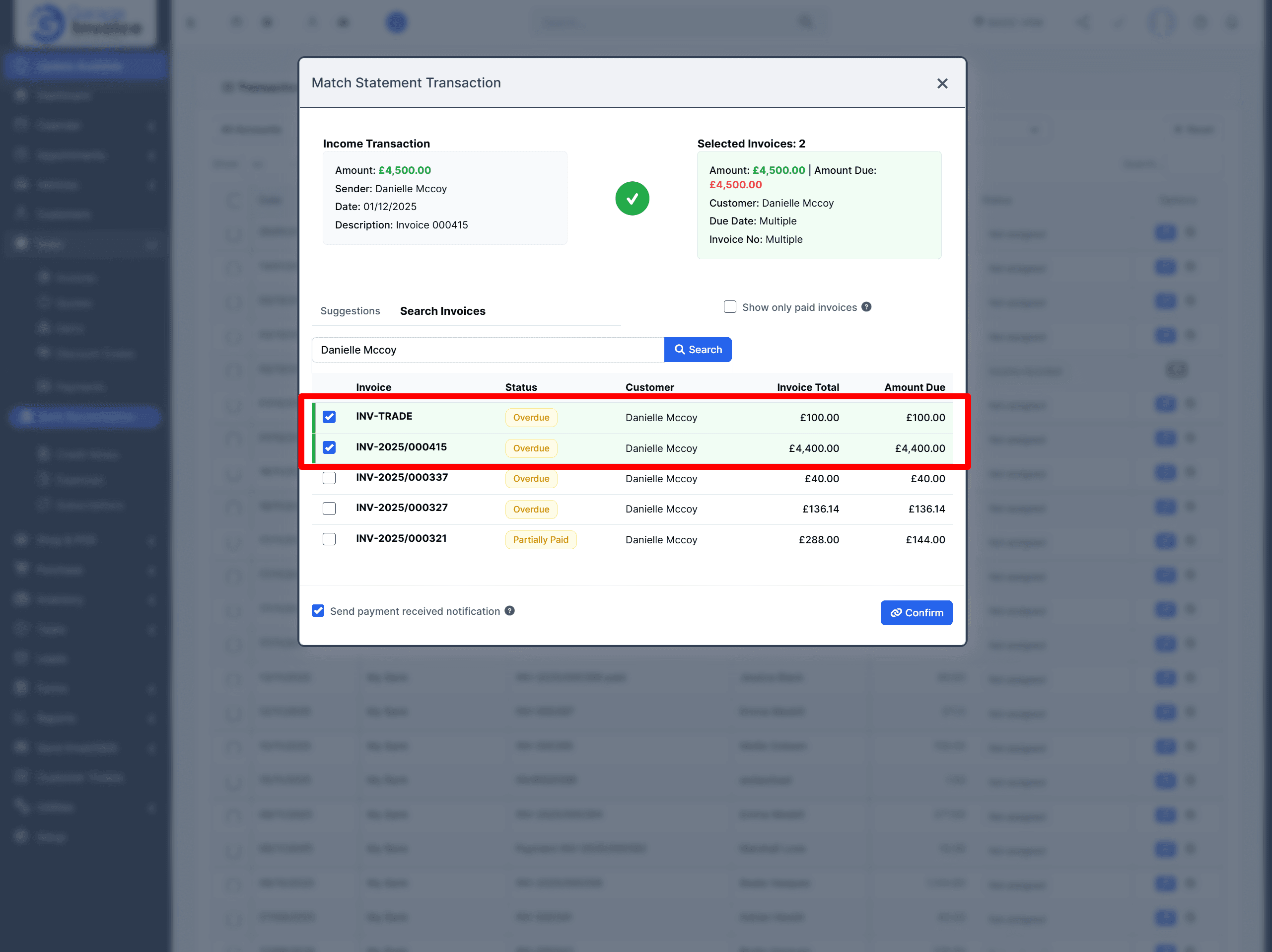

You can also select multiple invoices if a customer has paid one amount to cover more than one invoice.

Overpayments and partial payments (how it’s handled)

If the selected invoices total is less than the bank payment (overpayment)

If the total value of the selected invoices is less than the income transaction amount, one of the invoices will be overpaid, and the extra amount will be visible on the customer’s statement.

Example:

A customer sends 1,000, and you reconcile it against an invoice worth 800.

Result: the invoice is marked as Paid, and it will show an overpayment of 200 on the customer’s statement.

If the selected invoices total is more than the bank payment (partial payment)

If the total value of the selected invoices is more than the income transaction amount, the invoice will be marked as Partially Paid, with the remaining balance still outstanding.

Example:

A customer sends 1,000, and you reconcile it against an invoice worth 1,200.

Result: the invoice is Partially Paid with 200 outstanding.

If you select multiple invoices

When multiple invoices are selected, the system applies the payment across them in order, marking invoices as paid until the payment runs out.

Example:

A customer sends 1,000, and you select invoices of 300, 500, and 400 (total 1,200).

Result:

300 invoice: Paid

500 invoice: Paid

400 invoice: Partially Paid (with 200 paid and 200 outstanding)